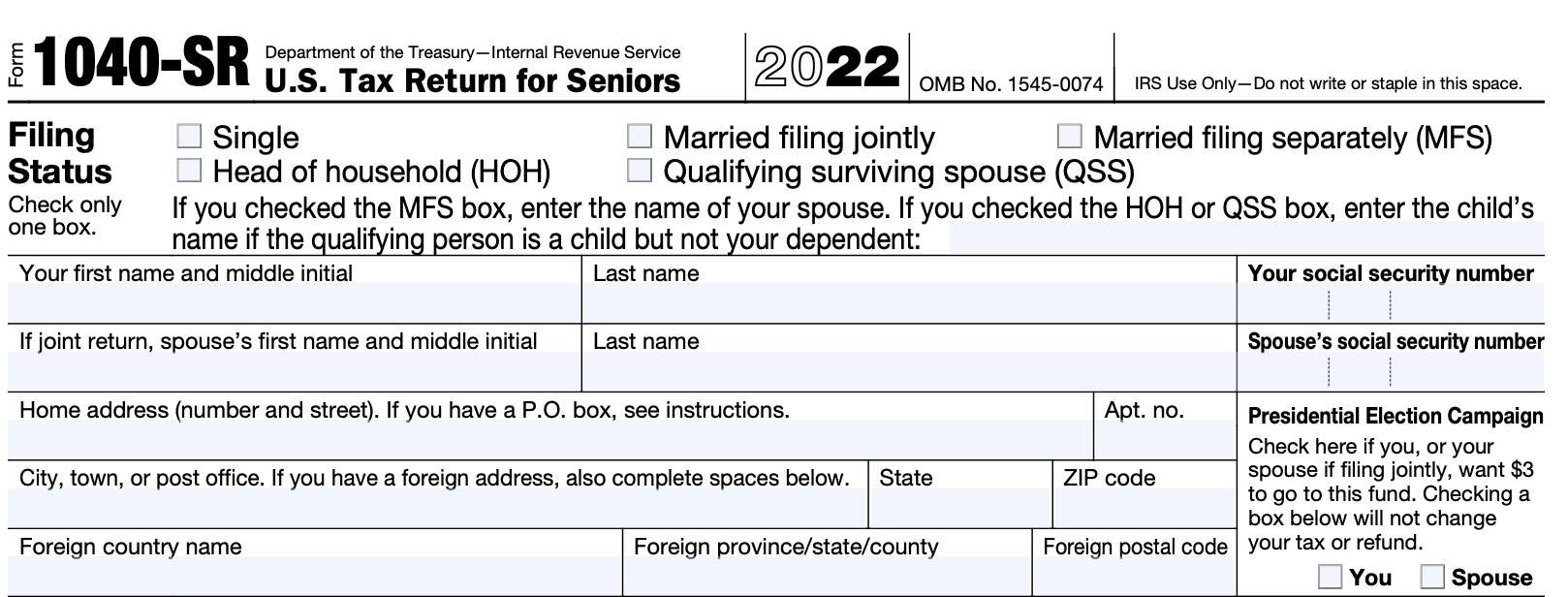

- Filing status

- Taxpayer information

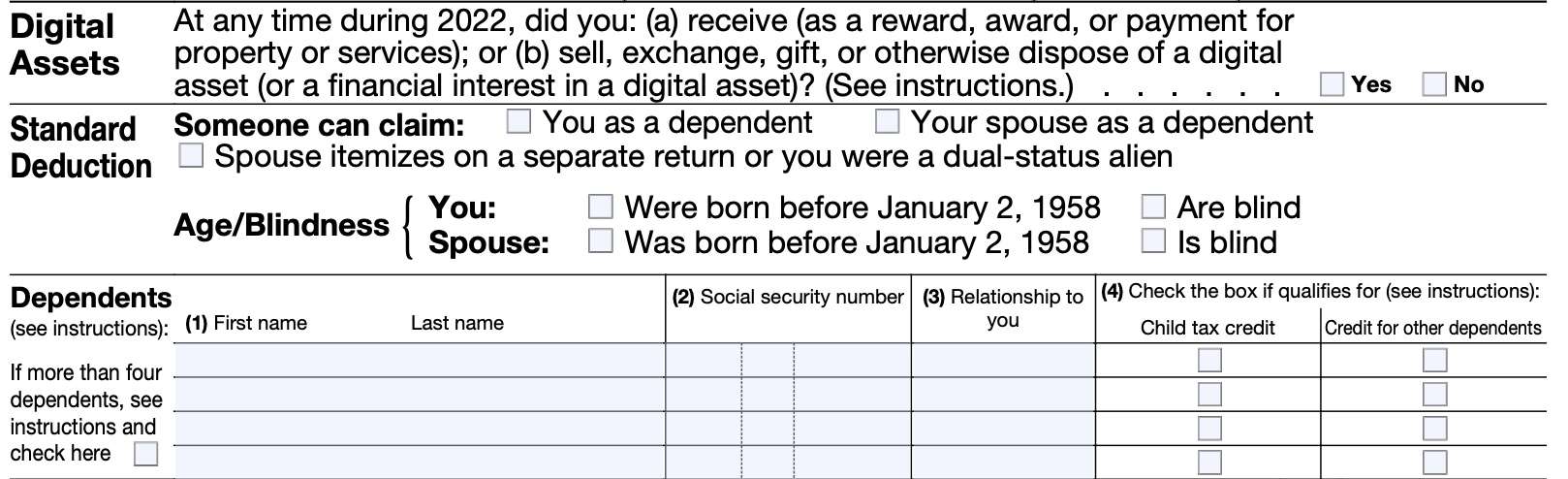

- Digital assets

- Standard deduction

- Dependents

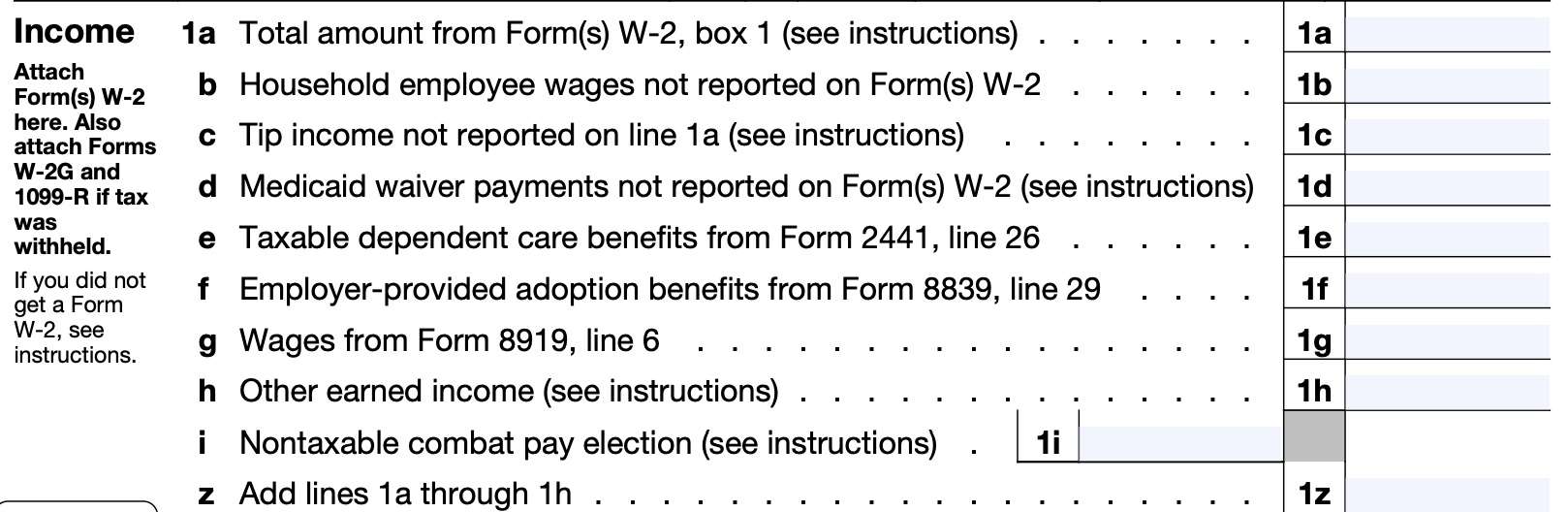

- Income (Line 1 through Line 15)

- Tax and credits (Line 16 through Line 24)

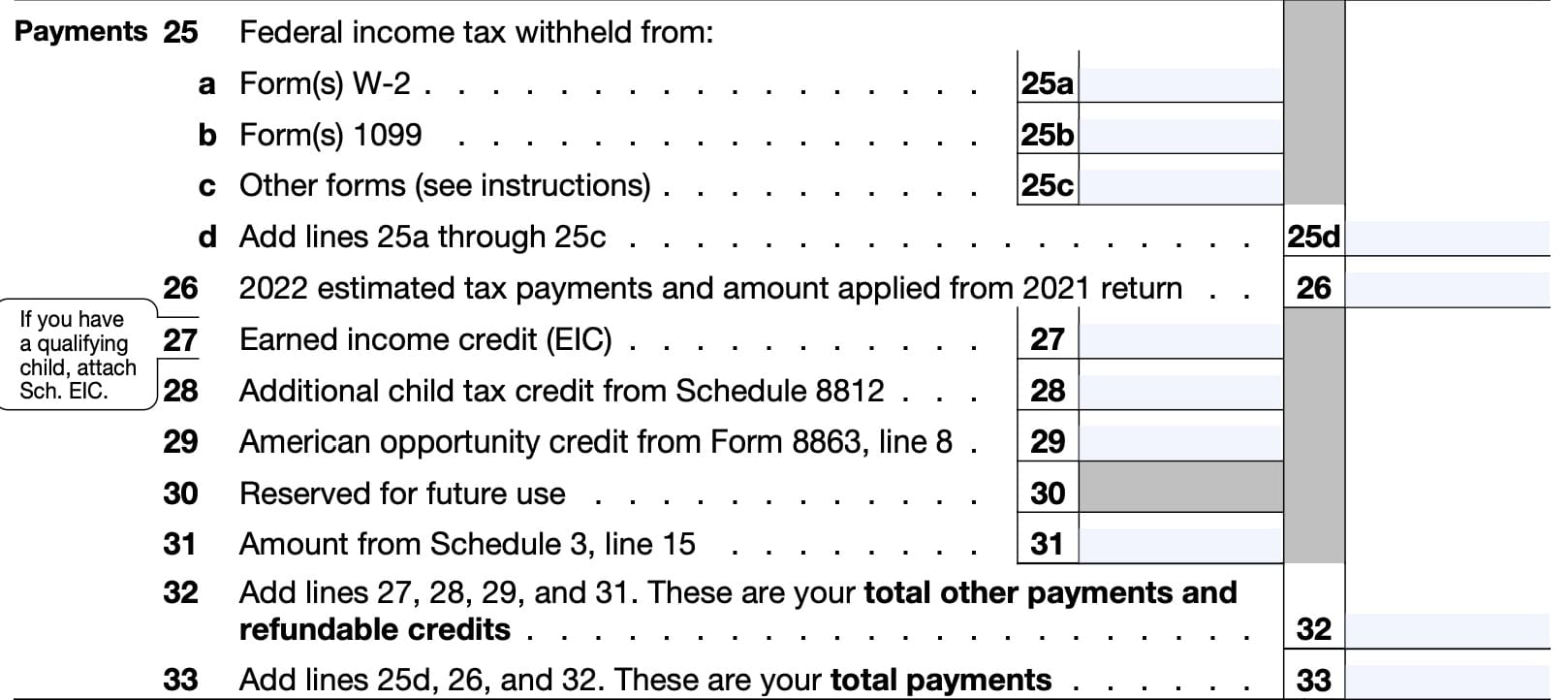

- Payments (Line 25 through Line 33)

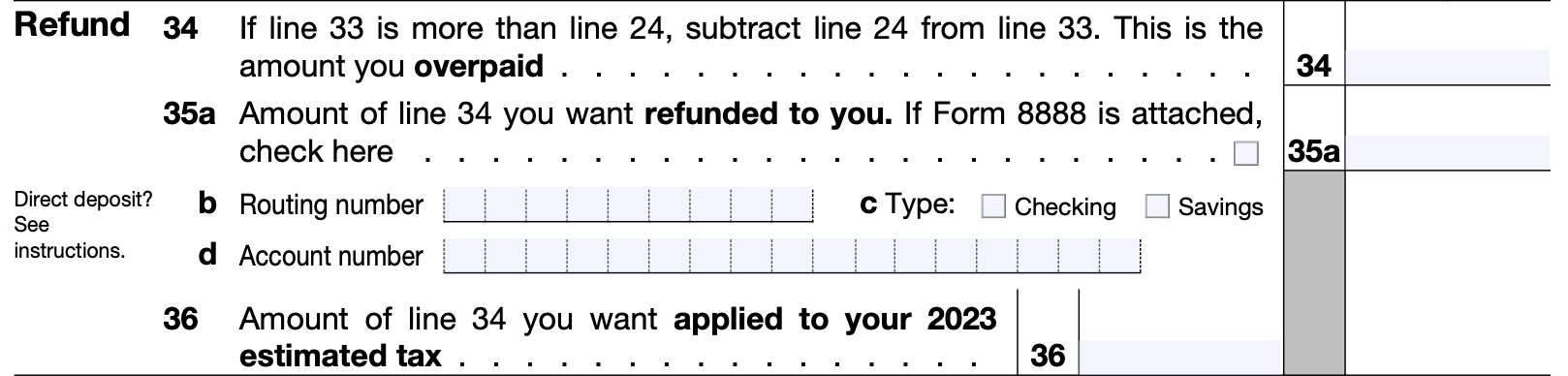

- Refund (Line 34 through Line 36)

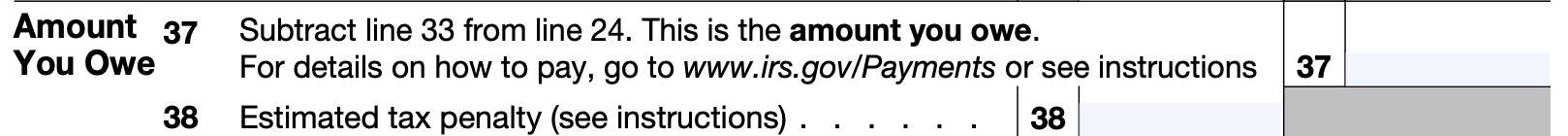

- Amount you owe (line 37 through Line 38)

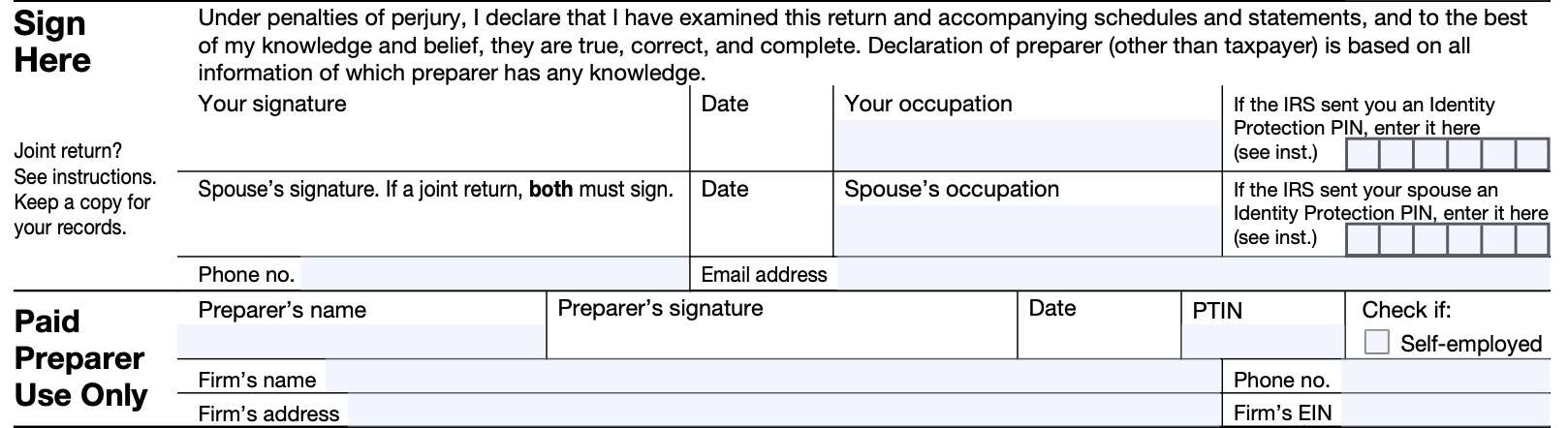

- Signature

How do I complete IRS Form 1040-SR?

This three-page tax form can be daunting. Let’s break it down, section by section, starting with the tax filing status at the top of the form.

Filing status

Check one box as it pertains to your tax filing status:

- Single

- Married filing jointly (MFJ)

- Married filing separately (MFS)

- Head of household (HOH)

- Qualifying surviving spouse (QSS)

If you selected married filing separately, you’ll need to list your spouse in the space provided (not in the spouse’s information field). For taxpayers who selected head of household or qualifying surviving spouse, you’ll need to list the child’s name if the qualifying person is a child who is not your dependent.

If you cannot decide which tax filing status applies to your situation, below is a little more information on each status type.

Single

Check the ‘Single’ box at the top of the tax form if any of the following was true as of the last day of the tax year:

- You were never married.

- You were legally separated according to your state law under a decree of divorce or separate maintenance.

- If, at the end of the year, your divorce wasn’t final (an interlocutory decree), you are considered married and can’t check the box.

- If you have a child, you may be able to use the qualifying surviving spouse filing status. See the instructions for Qualifying Surviving Spouse.

Married filing jointly

Check the ‘Married filing jointly’ box at the top of the form if any of the following apply:

- You were married at the end of the taxable year, even if you didn’t live with your spouse at the end of the year.

- Your spouse died during the tax year and you didn’t remarry in the tax year.

- You were married at the end of the tax year and your spouse died in the following tax year before filing your income tax return.

A married couple filing jointly report their combined income and deduct their combined allowable expenses on one income tax return. They can file a joint return even if only one had income or if they didn’t live together all year.

However, both persons must sign the return. Once you file a joint return, you can’t choose to file separate returns for that year after the due date of the return.

Married filing separately

Check this box if you are married, at the end of the tax year, and file a separate return. Enter your spouse’s name in the entry space below the filing status checkboxes.

Be sure to enter your spouse’s Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN) in the space for spouse’s SSN. If your spouse doesn’t have and isn’t required to have an SSN or ITIN, enter “NRA” in the entry space below the filing status checkboxes.

For electronic filing, enter the spouse’s name or “NRA” if the spouse doesn’t have an SSN or ITIN in the entry space below the filing status checkboxes.

If you are married and file a separate return, you generally report only your own income, deductions, and credits. As a general rule, you are responsible only for the tax on your own income.

However, you generally will pay more income tax than if you use another tax filing status.

Also, if you file a separate return, the following restrictions will apply:

- You cannot take the student loan interest deduction or education tax credits

- Your ability to take the earned income credit (EIC) and child and dependent care credit will be limited

- You cannot take the standard deduction if your spouse itemizes deductions on Schedule A of his or her income tax return

Head of household

Check the ‘Head of household’ box if

- You are unmarried, and

- Provide a home for certain other people

Unmarried taxpayers

The Internal Revenue Service considers you to be unmarried for this purpose if any of the following applies:

- You were legally separated according to your state law under a decree of divorce or separate maintenance at the end of the tax year.

- But if, at the end of the tax year, your divorce wasn’t final (an interlocutory decree), you are considered married.

- You lived apart from your spouse for the last 6 months of the tax year

- Temporary absences, such as medical care, school, or business trips count as time lived in the home, not living apart

To check this box, one of the two following tests must also apply to your situation.

Test 1

You paid over half the cost of keeping up a home that was the main home for all of the tax year of your parent whom you can claim as a dependent, except under a multiple support agreement. Your parent does not need to live with you to qualify.

Test 2

You paid over half the cost of keeping up a home in which you lived and in which one of the following also lived for more than half of the year:

- Any person whom you can claim as a dependent, not including:

- A child whom you claim as a dependent

- Any person who is your dependent only because he or she lived with you the entire tax year

- Any person you claimed as a dependent under a multiple support agreement

Qualifying surviving spouse

Check the ‘Qualifying surviving spouse’ box at the top of your return and use joint return tax rates for the tax year if all of the following apply:

- Your spouse died in the preceding year or year before, and you didn’t remarry before the end of the tax year.

- Example: If your spouse passed away in 2021 or 2022, and you did not marry before the end of 2023, then you could claim QSS status for the 2023 tax year

- The child had gross income of $4,400 or more

- The child filed a joint income tax return

- Someone else could claim you as a dependent on their tax return

- If the child isn’t your dependent, enter the child’s name in the entry space below the filing status checkboxes.

If your spouse passed away during the tax year, you cannot claim QSS status. Instead, check the criteria for Married Filing Jointly, above.

Taxpayer information

In this section, you’ll enter some personal information. Most of the fields are straightforward, but there is additional information you may need to know.

First name, middle initial, and last name

If you’ve recently changed your name, be sure to report your name change to the Social Security Administration.

You may do this by completing Form SS-5, Application for Social Security Card, and bringing your completed form to the local Social Security office, as well as proof of your name change (i.e. marriage certificate, divorce decree, etc.).

Spouse’s name

Enter your spouse’s name if you’re married and filing a joint tax return. If you filed a joint income tax return in prior taxable years, then be sure that your name and your spouse’s name appear in the same order as on the previous tax returns.

If you’re married filing separate returns, do not enter your spouse’s name here. Instead, enter your spouse’s name in the filing status fields.

Social Security number

Enter your SSN here.

If you have an individual taxpayer identification number (ITIN), enter that number instead. For individuals with an ITIN who recently received an SSN, use your SSN, not your ITIN.

Spouse’s Social Security number

If applicable, enter your spouse’s SSN or ITIN here.

Home address

Enter your home address here. If you plan to move after filing your federal income tax return, then you may need to report your move to the Internal Revenue Service by filing IRS Form 8822, Change of Address.

Presidential election campaign

Check this box if you (or your spouse) would like $3 of your tax liability to go to the Presidential Election Campaign Fund, which helps fund Presidential election campaigns.

Checking this box does not increase your tax bill or decrease the tax refund amount you might otherwise receive. Rather, it takes $3 from your tax liability and diverts it to the Presidential Election Campaign Fund.

Digital assets

In this section, you’ll declare whether or not you:

- Received digital assets as a reward, award, or payment for goods and services during the tax year, or

- Disposed of digital assets during the tax year

What are digital assets?

Digital assets are any digital representations of value that are recorded on a cryptographically secured distributed ledger or similar technology.

The IRS considers the following to be digital assets:

- Non-fungible tokens (NFTs)

- Virtual currencies, including cryptocurrency or stablecoins

If a particular asset has the characteristics of a digital asset, it will be treated as a digital asset for federal income tax purposes.

Check ‘Yes’ if at any time during the tax year you:

- Received digital assets as payment for property or services provided;

- Received digital assets as a result of a reward or award;

- Received new digital assets as a result of mining, staking, and similar activities;

- Received digital assets as a result of a hard fork;

- Disposed of digital assets in exchange for property or services;

- Disposed of a digital asset in exchange or trade for another digital asset;

- Sold a digital asset;

- Transferred digital assets for free as a bona fide gift; or

- Otherwise disposed of any other financial interest in a digital asset.

Financial interest in digital assets

You have a financial interest in a digital asset if:

- You are the owner of record of a digital asset

- Have an ownership stake in an account that holds one or more digital assets

- This includes the rights and obligations to acquire a financial interest

You generally do not need to check ‘Yes’ if your only actions or transactions consist of one of the following:

- Holding a digital asset in a wallet or account;

- Transferring a digital asset from one wallet or account you own or control to another wallet or account that you own or control; or

- Purchasing digital assets using U.S. or other real currency

- Even if purchased by using electronic platforms such as PayPal and Venmo.

Do not leave the question unanswered. You must answer “Yes” or “No” by checking the appropriate box.

Reporting digital asset transactions

Check ‘Yes’ and complete Form 8949 to calculate capital gain or loss if you disposed of any digital asset, which you held as a capital asset, through any of the following transactions:

- Sale

- Trade

- Exchange

- Payment

- Other transfer

If you gifted digital assets, you’ll report the gift on IRS Form 709, if the gift is reportable.

If you received any digital asset as compensation for services or disposed of any digital asset that you held for sale to customers in a trade or business, you must report the income as you would report other income of the same type

For example, if you received wages in the form of digital assets, report them on Line 1a, below. If you received digital assets as compensation for services performed in your sole proprietorship, report them on IRS Schedule C.

Standard deduction

Check the appropriate box if any of the following apply:

- Someone can claim you as a dependent on their U.S. tax reutrn

- Someone can claim your spouse as a dependent on their tax return

- Your spouse itemizes deductions on a separate tax return, or you were a dual-status alien during the tax year

However, do not check the dual-status alien box if:

- You were a dual status alien, and

- You file a joint return with your spouse who was a U.S. citizen or resident at the end of the tax year, and

- You and your spouse agree to be taxed on your combined worldwide income

Age/blindness

Check the appropriate age box if you or your spouse were age 65 or older by the end of the tax year (including January 1). For the 2023 tax year, this includes anyone who was born on January 2, 1959 or earlier.

Blindness

If you weren’t totally blind as of the end of the tax year, you must get a statement certified by your eye doctor (ophthalmologist or optometrist) that:

- You can’t see better than 20/200 in your better eye with glasses or contact lenses, or

- Your field of vision is 20 degrees or less.

If your eye condition isn’t likely to improve beyond the conditions listed above, you can get a statement certified by your eye doctor (ophthalmologist or optometrist) to this effect instead. Keep this statement for your records.

If you receive a notice or letter but you would prefer to have it in Braille or large print, you can use IRS Form 9000, Alternative Media Preference, to request notices in an alternative format including:

- Braille

- Large print

- Audio

- Electronic

You may attach Form 9000 to your return or mail it separately.

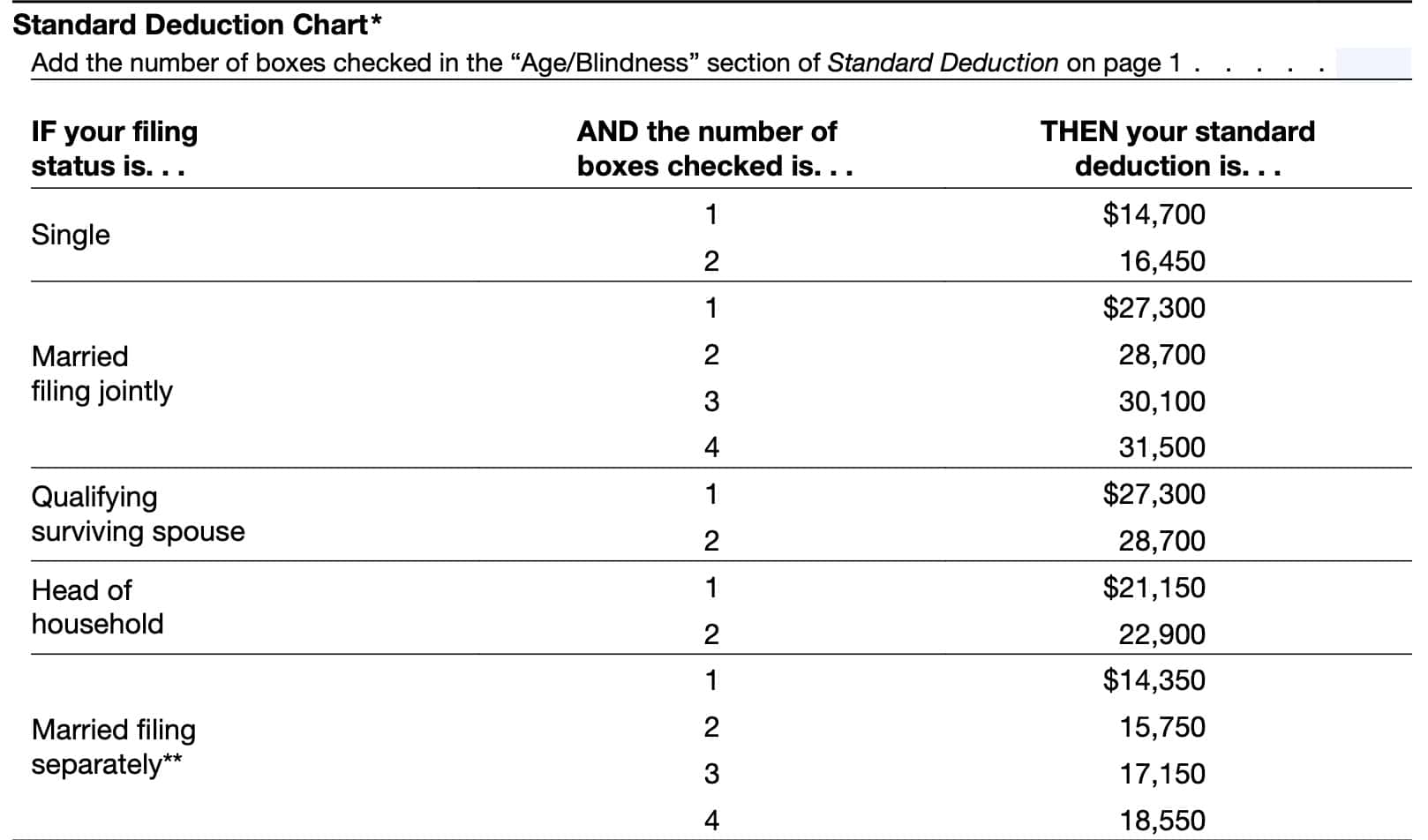

How much is my standard deduction?

The IRS provides a standard deduction chart that helps eligible taxpayers determine their standard deduction amounts based upon:

In the chart, enter the number of boxes that checked in the ‘Age/Blindness’ section. Use that number, and your filing status to determine the amount of your standard deduction.

Dependents

For each dependent that you claim on your income tax return, enter the following information:

- First name

- Last name

- Social Security number

- Relationship to you

Also, check the appropriate box if your dependent is eligible for either the child tax credit or the credit for other dependents.

If you are claiming more than 4 dependents, then check the appropriate box and attach a separate statement containing the requested information.

Does my child or dependent qualify for the child tax credit or credit for other dependents?

If you are not sure whether your child or dependent qualifies for the child tax credit or the credit for other dependents, the IRS provides a 5-step test, outlined below.

Step 1: Do you have a qualifying child?

The IRS considers a qualifying child as a child who is your:

- Son or daughter

- Stepchild

- Foster child

- Brother or sister

- Stepbrother or stepsister

- Half brother or half sister

- Descendent of any of the relatives listed above

The child must also meet the following criteria:

- Under the age of 19 at the end of the tax year and is younger than you (or your spouse, if filing a joint tax return), and

- May be under the age of 24 if enrolled as a student

- May be any age if considered totally and permanently disabled

- May file a joint return if the only reason is to claim a refund of taxes paid

- Exceptions exist for special circumstances, such as school, vacation, kidnapping, business, medical care, military service, or detention in a juvenile facility

If you have a child that meets this criteria, go to Step 2, below. Otherwise, go to Step 4, below.

Step 2: Is your qualifying child your dependent?

In Step 2, there are several questions.

1. Was the child a U.S. citizen, U.S. national, U.S. resident alien, or a resident of Canada or Mexico?

If so, go to the next question. If not, you cannot claim the child as a dependent.

2. Was the child married?

If not, go to the next question. If so, and he or she filed a joint return, you cannot claim that child as a dependent unless the joint return was filed solely to obtain a refund of income taxes or estimated taxes paid.

3. Could you, or your spouse if filing a joint return, be claimed as a dependent on someone else’s tax return?

If so, you cannot claim any dependents on your federal tax return. If not, go to Step 3.

Step 3: Does Your Qualifying Child Qualify You for the Child Tax Credit or Credit for Other Dependents?

In Step 3, you’ll determine whether your child qualifies for the child tax credit or the credit for other dependents.

1. Did the child have any of the following as of the date that you filed your tax return:

- SSN

- ITIN

- Adoption Taxpayer Identification Number (ATIN)

If so, go to the next question. If not, you cannot claim either tax credit for the child.

2. Was the child a U.S. citizen, U.S. national, or U.S. resident alien?

If ‘Yes,’ go to the next question. If not, you cannot claim either tax credit for the child.

3. Was the child under age 17 at the end of the tax year?

If so, go to the next question. If not, you cannot claim the child tax credit, but you may be able to claim the credit for other dependents. Check the ‘Credit for other dependents’ box in column (4) for this person.

4. Did this child have an SSN valid for employment issued before the due date of your tax return?

If so, you can claim the child tax credit. Check the ‘Child tax credit’ box in column (4) for this person.

If not, you cannot claim the child tax credit, but you may be able to claim the credit for other dependents. Check the ‘Credit for other dependents’ box in column (4) for this person.

Step 4: Is Your Qualifying Relative Your Dependent?

A qualifying relative is one of the following:

- Son, daughter, stepchild, foster child, or a descendant

- Brother, sister, half brother, half sister, or a son or daughter

- Father, mother, or an ancestor or sibling of either

- Stepbrother, stepsister, stepparent, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law

- Any other person (besides your spouse) who lived with you all year as a member of your household if your relationship didn’t violate local law

A qualifying relative must also meet the following criteria:

- Wasn’t a qualifying child as defined in Step 1

- Who had gross income of less than $4,400 in the tax year

- Exception exists for someone who is considered totally and permanently disabled

- Exceptions exist for kidnapping victims, children of divorced or separated parents, and multiple support agreements

Additional questions

If the person meets the above criteria, the IRS has additional questions:

1. Was your qualifying relative a U.S. citizen, U.S. national, U.S. resident alien, or a resident of Canada or Mexico?

If ‘Yes,’ go to the next question. If not, you cannot claim a tax credit.

2. Was your qualifying relative married?

If ‘No,’ go to the next question. If ‘Yes,’ go to the next question only if that person did not file a joint tax return, or if the only reason he or she filed a joint return was to receive a refund for taxes paid during the year.

3. Could you, or your spouse if filing a joint return, be claimed as a dependent on someone else’s tax return?

If so, you cannot claim any dependents on your federal tax return. If not, you can claim this person as a dependent. Complete columns (1) through (3) of the dependents field, then proceed to Step 5 to determine if your relative qualifies for the credit for other dependents.

Step 5: Does Your Qualifying Relative Qualify You for the Credit for Other Dependents?

1. Did the relative have any of the following as of the date that you filed your tax return:

- SSN

- ITIN

- Adoption Taxpayer Identification Number (ATIN)

If so, go to the next question. If not, you cannot claim a tax credit for this person.

2. Was your qualifying relative a U.S. citizen, U.S. national, or a U.S. resident alien?

If so, you can claim the credit for other dependents. Otherwise, you cannot.

Income (Line 1 through Line 15)

In this section, you will report all items of income. Let’s start at the top with Line 1a.

Line 1a: Total amount from Form(s) W-2, Box 1

Enter the total amount reported to you on IRS Form W-2, Box 1. If you’re filing a joint tax return, also include your spouse’s income from Form(s) W-2, Box 1.

Wages earned in a penal institution

If you earned wages while you were an inmate in a penal institution, report these amounts on IRS Schedule 1, Line 8u. Do not report those wages on Line 1a.

Deferred compensation

If you received a pension or annuity from a nonqualified deferred compensation plan or a nongovernmental section 457(b) plan and it was reported in Box 1 of Form W-2, do not include this amount on Line 1a.

Report on Schedule 1, Line 8t.

Line 1b: Household employee wages not reported on Form(s) W-2

Enter the total of your wages received as a household employee that was not reported on Form(s) W-2.

An employer isn’t required to provide a Form W-2 to you if they paid you wages of less than $2,400 during the tax year.

Line 1c: Tip income not reported on Line 1a

Enter the total of your tip income you did not report on Line 1a, above. This should include:

- Any tip income you didn’t report to your employer and

- Any allocated tips shown in box 8 on your Form(s) W-2

- Unless you can prove that your unreported tips are less than the amount in Box 8.

Also include the value of any noncash tips you received. This might include items such as tickets, passes, or other items of value.

Unreported tip income

You may owe Social Security and Medicare tax or railroad retirement (RRTA) tax on unreported tip income.

Line 1d: Medicaid waiver payments not reported on Form(s) W-2

Enter any taxable Medicaid waiver payments that were not reported on Form(s) W-2. Also enter the total of your taxable and nontaxable Medicaid waiver payments that were either:

- Not reported on Form W-2, or

- Not reported in Box 1 of Form W-2 if you choose to include nontaxable payments in earned income for purposes of claiming a tax credit or other tax benefit

If you and your spouse both received nontaxable Medicaid waiver payments during the year, you and your spouse can make different decisions about including payments in earned income.

Line 1e: Taxable dependent care benefits from IRS Form 2441, Line 26

Enter the total of your taxable dependent care benefits from Line 26 on IRS Form 2441. Dependent care benefits will appear in Box 10 of your Form(s) W-2.

Prior to entering any number, you should complete Form 2441 to see if you can exclude part or all of the dependent care benefits.

Line 1f: Employer-provided adoption benefits from Form 8839, Line 29

Enter the total of your employer-provided adoption benefits from IRS Form 8839, Line 29. Employer-provided adoption benefits should be shown in Box 12 of your Form(s) W-2 with code T.

Prior to entering any number, look at the instructions for IRS Form 8839 to find out if you can exclude part or all of the benefits from taxable income.

You may also be able to exclude amounts if:

- You adopted a child with special needs, and

- The adoption became final during the tax year

Line 1g: Wages from Form 8919, Line 6

Report the total of any wages that you reported on IRS Form 8919, Line 6. These are wages for which your employer did not collect Social Security or Medicare tax because your employer considered you to be a contractor, not an employee.

Line 1h: Other earned income

Enter the following types of earned income on Line 1h:

- Strike or lockout benefits (other than bona fide gifts)

- Excess elective deferrals

- Shown on Box 12 on your Form W-2, with ‘Retirement plan’ box checked in Box 13

- Exceptions exist for insurance premiums paid by retired public safety officers, who report these amounts on Line 5a and Line 5b, below

- Report disability pensions received after you reach minimum retirement age on Line 5a and Line 5b, below

- Not including IRA distributions, which are reported on Line 4a and Line 4b, below

Line 1i: Nontaxable combat pay election

If you elect to include your nontaxable combat pay in your earned income when figuring the EIC, enter the amount here.

Line 1z

Add the totals of Lines 1a through 1h. Enter the total here.

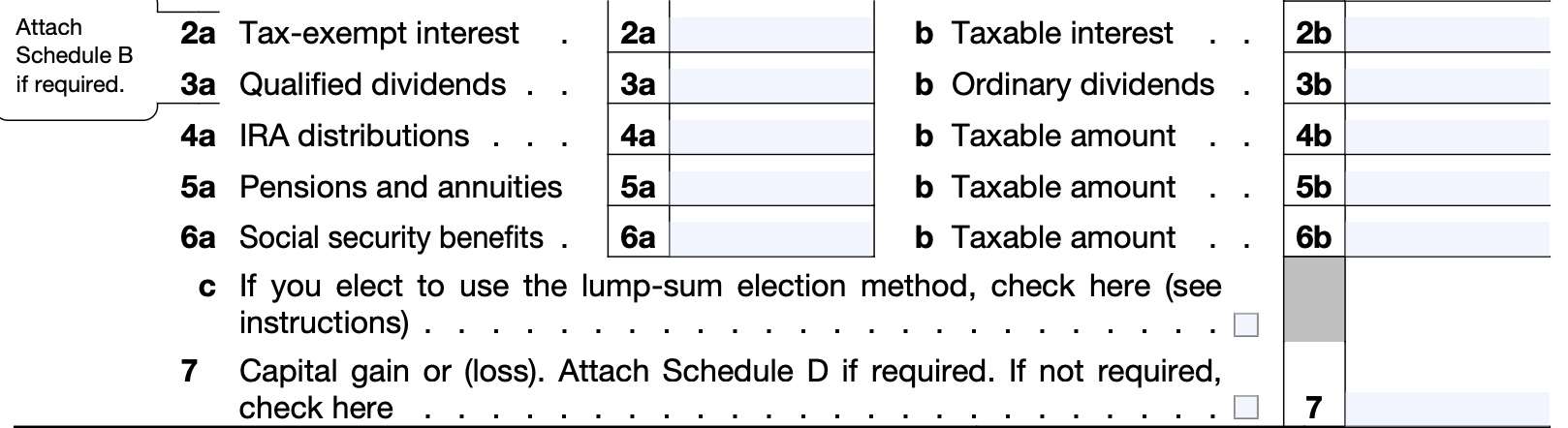

Line 2a: Tax-exempt interest

In general, your tax-exempt stated interest should be shown in Box 8 of Form 1099-INT. In the case of a tax-exempt OID bond, you’ll find the following:

- Tax-exempt interest reported in Box 2

- Tax-exempt OID reported in Box 11

Enter the total on Line 2a.

Tax-exempt bond at a premium

If you acquired a tax-exempt bond at a premium, only report the net amount of tax-exempt interest on Line 2a. The net amount is the excess of the tax-exempt interest received during the year over the amortized bond premium for the year.

If you acquired a tax-exempt OID bond at an acquisition premium, only report the net amount of tax-exempt OID on Line 2a. This is the excess of tax-exempt OID for the year over the amortized acquisition premium for the year.

IRS Publication 550, Investment Income and Expenses, contains additional information about OID, bond premium, and acquisition premium.

Tax-exempt interest dividends

If you received any exempt-interest dividends from a mutual fund or other regulated investment company, you should see them reported in Box 12 on Form 1099-DIV. Report this amount as tax-exempt interest in Line 2a.

What not to report

Do not report any interest earned in any of the following accounts:

- Traditional IRA

- Roth IRA

- Health savings account (HSA)

- Archer or Medicare Advantage MSA

- Coverdell education savings account

Also, do not report anything related to PPP loan forgiveness in this line.

Line 2b: Taxable interest

Enter your total taxable interest income on Line 2b, as reported on IRS Form 1099-INT or IRS Form 1099-OID.

You may need to complete IRS Schedule B if:

- Your total taxable interest exceeds $1,500 for the year, or

- Any of the other conditions of IRS Schedule B apply to your tax situation

Line 3a: Qualified dividends

Enter your total qualified dividends on Line 3a. Qualified dividends are eligible for a lower tax rate than other ordinary income.

Generally, these dividends are shown in Box 1b of Form(s) 1099-DIV.

Qualified dividends are also included in the ordinary dividend total indicated in Line 3b, below.

Exceptions

Do not include any of the following, even if reported to you on Form 1099-DIV:

- Dividends you received as a nominee.

- Dividends you received on any share of stock that you held for less than 61 days during the 121-day period that began 60 days before the ex-dividend date.

- The ex-dividend date is the first date following the declaration of a dividend on which the purchaser of a stock isn’t entitled to receive the next dividend payment.

- When counting the number of days you held the stock, include the day you disposed of the stock but not the day you acquired it.

- Other than a foreign corporation that is treated as a domestic corporation under Internal Revenue Code Section 7874(b)

Line 3b: Ordinary dividends

Enter your total ordinary dividends on Line 3b. This amount should be shown in Box 1a of Form(s) 1099-DIV.

You must fill in and attach Schedule B if

- The total dividends you received exceeds $1,500, or

- You received ordinary dividends as a nominee that belong to someone else

Line 4a & Line 4b: IRA distribution

You should receive a Form 1099-R showing the total amount of any distribution from your IRA before income tax or other deductions were withheld. You should see the total distribution amount in Box 1.

Unless otherwise noted, an IRA includes the following:

- Traditional IRA

- Roth IRA

- Simplified employee pension (SEP) IRA, and

- Savings incentive match plan for employees (SIMPLE) IRA

Generally, leave Line 4a blank and enter the total distribution (from Form 1099-R, Box 1) on Line 4b. However, there are exceptions that apply.

Exception #1: IRA Rollovers

Enter the total distribution on Line 4a if you rolled over part or all of the distribution from one:

- Roth IRA to another Roth IRA, or

- IRA (except for a Roth IRA) to a qualified plan or another IRA (other than a Roth IRA).

In this situation, enter “Rollover” next to Line 4b. If the total distribution was rolled over, enter ‘0’ on Line 4b.

If the total distribution wasn’t rolled over, enter the part not rolled over on Line 4b unless Exception 2 applies to the part not rolled over.

Generally, you must make a rollover within 60 days after the day you received the distribution.

Exception #2: Transactions reported on IRS Form 8606

If any of the following conditions apply, then you should enter the total distribution on Line 4a, then review IRS Form 8606, Nondeductible IRAs, and the form instructions to determine the amount to enter on Line 4b:

- You received a distribution from an IRA, other than a Roth IRA, and you made nondeductible contributions to any of your traditional or SEP IRAs for the current tax year or an earlier year.

- If you made nondeductible contributions to these IRAs for the tax year, you may need to refer to IRS Publications 590-A and 590-B for further guidance.

- You received a distribution from a Roth IRA.

- But if either (a) or (b) below applies, enter ‘0’ on Line 4b. You don’t have to refer to Form 8606 or its instructions.

- Distribution code T is shown in Box 7 of Form 1099-R and you made a contribution, including Roth conversions, to a Roth IRA for 2017 or an earlier year.

- Distribution code Q is shown in Box 7 of Form 1099-R.

Exception #3: Qualified charitable distributions

If all or part of the distribution is a qualified charitable distribution (QCD), then

- Enter the total distribution on Line 4a

- Enter the part of the distribution that is not a QCD on Line 4b, unless Exception #2 applies to the remaining part.

- If the entire distribution is a QCD, enter ‘0’ on Line 4b

What is a Qualified Charitable Distribution?

A QCD is a distribution made directly by the trustee of your IRA, other than an ongoing SEP or SIMPLE IRA, to an organization eligible to receive tax-deductible contributions (with certain exceptions).

Age requirement: You must have been at least age 70 1/2 when the distribution was made.

Generally, your total QCDs for the year cannot exceed $100,000. For joint returns, each spouse may have a QCD up to $100,000.

The amount of the QCD is limited to the amount that would otherwise be included in your income. If your IRA includes nondeductible contributions, the distribution is first considered to be paid out of otherwise taxable income.

You cannot claim a charitable contribution deduction for any QCD not included in your income.

Exception #4: Health savings account funding distributions

If all or part of the distribution is a health savings account (HSA) funding distribution (HFD), then

- Enter the total distribution on Line 4a.

- Enter the part of the distribution that is not an HFD in Line 4b, unless Exception #2 applies to that part.

- If the entire distribution is an HFD, enter ‘0’ on Line 4b.

What is an HSA funding distribution?

An HFD is a distribution made directly by the trustee of your IRA (other than an ongoing SEP or SIMPLE IRA) to your HSA. If eligible, you can generally elect to exclude an HFD from your income once in your lifetime.

You can’t exclude more than the limit on HSA contributions or more than the amount that would otherwise be included in your income. If your IRA includes nondeductible contributions, the HFD is first considered to be paid out of otherwise taxable income.

Line 5a & Line 5b: Pensions and annuities

You should receive a Form 1099-R showing the total amount of your pension and annuity payments before income tax or other deductions were withheld, in Box 1.

Pension and annuity payments include distributions from 401(k), 403(b), and governmental 457(b) plans.

Don’t include the following payments on Lines 5a and 5b. Instead, report them on Line 1h, above.

- Disability pensions received before you reach the minimum retirement age set by your employer.

- Corrective distributions (including any earnings) of excess elective deferrals or other excess contributions to retirement plans.

- The plan must advise you of the year(s) the distributions are includible in income.

If your pension or annuity is fully taxable

Your payments are fully taxable if:

- You did not contribute to the cost of your pension or annuity, or

- You received your entire cost back tax free before the beginning of the tax year

Fully taxable pensions and annuities also include military retirement pay shown on Form 1099-R.

If your pension or annuity is fully taxable, then you should:

- Enter the total pension or annuity payments from Form(s) 1099-R, Box 1 on Line 5b

- Do not enter anything on Line 5a

If your pension or annuity is partially taxable

Enter the total pension or annuity payments from Form(s) 1099-R, Box 1 on Line 5a. If your Form 1099-R shows a taxable amount, you can report that amount on Line 5b.

If your Form 1099-R does not show a taxable amount, then you must use one of the following methods to calculate the taxable amount:

- General rule, as explained in IRS Publication 939, General Rule for Pensions and Annuities

- Simplified method, as explained in IRS Publication 575, Pension and Annuity Income

Retired public safety officers may use tax-free distributions (up to $3,000 per year) to pay for health insurance premiums.

Line 6a: Social Security benefits

If you received Social Security benefits during the year, you should receive a Form SSA-1099. Box 3 will show the total Social Security benefits you received, and Box 4 will indicate any benefits that you repaid during the tax year.

If you received railroad retirement benefits that are treated as Social Security, you’ll receive Form RRB-1099 instead of Form SSA-1099.

Line 6b: Taxable amount

To determine the taxable amount of your Social Security benefits, you may need to follow the Social Security benefits worksheet (outlined below), unless one of the following conditions applies:

- You made contributions to a traditional IRA for the tax year and you or your spouse were covered by a retirement plan at work or through self-employment.

- Use the worksheets in IRS Publication 590-A to see if any of your Social Security benefits are taxable and to figure your IRA deduction

- Your benefits are not taxable for the year

- If Box 4 exceeded Box 3 by more than $3,000, you may be able to take a tax deduction or tax credit for part of the benefits if they were included in taxable income in a prior tax year

- IRS Form 2555, Foreign Earned Income

- IRS Form 4563 to exclude income from American Samoa

- IRS Form 8815 to exclude interest from U.S. savings bonds used for education purposes

- IRS Form 8839 to exclude employer-provided adoption benefits

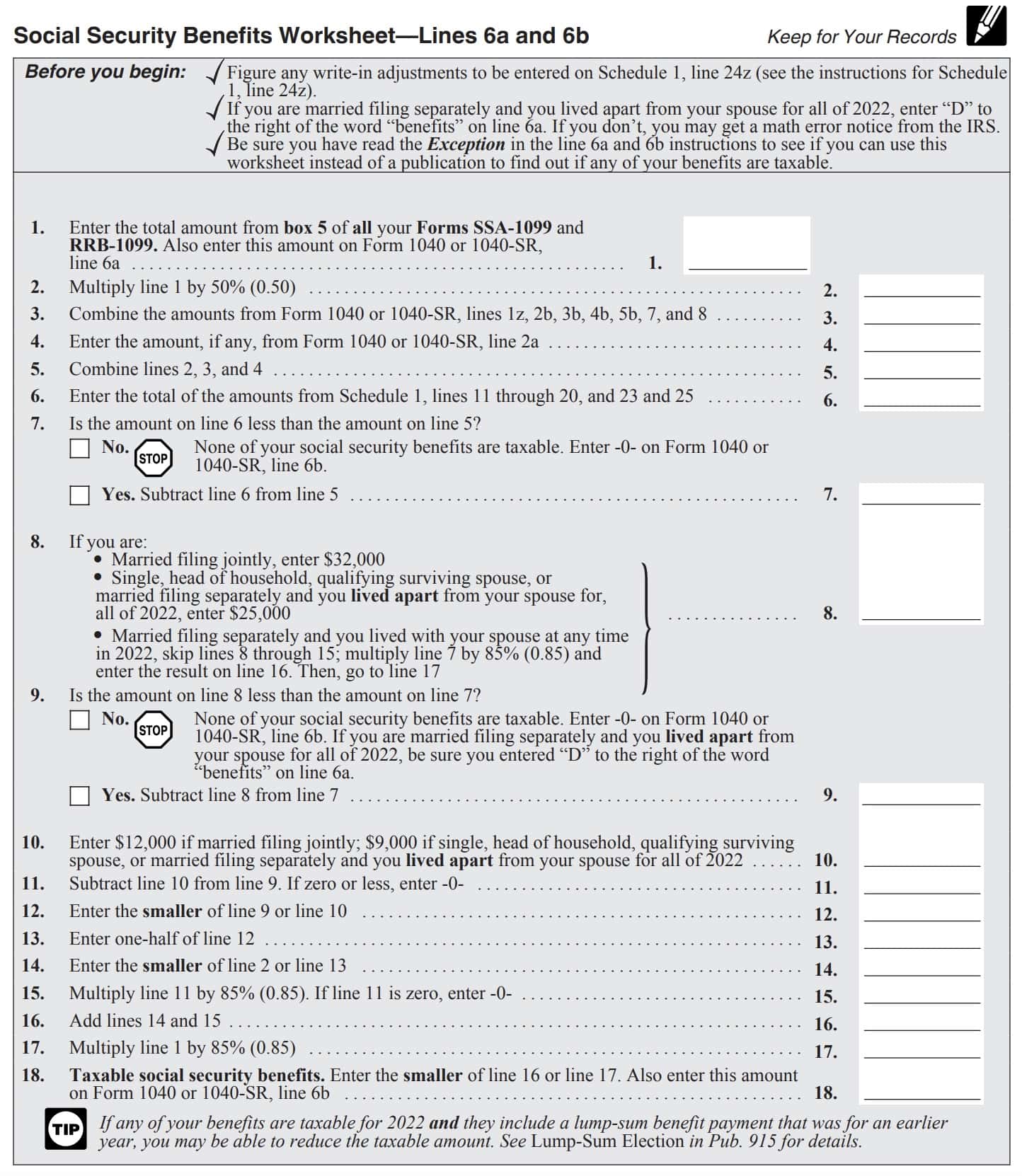

Social Security benefits worksheet

If you do not need to use the worksheet from IRS Publication 915, you may use the following Social Security benefits worksheet to calculate your taxable Social Security benefits:

Line 6c: Lump-sum election method

Check the box here if you elect to use the lump-sum election method for your Social Security benefits.

If any of your benefits are taxable for the year and they include a lump-sum benefit payment that was for an earlier year, you may be able to reduce the taxable amount with the lump-sum election.

You can find more details about the lump-sum election method in IRS Publication 915.

Line 7: Capital gain or loss

Enter any capital gain or loss from the sale of capital assets in Line 7.

Generally, you must file IRS Form 8949 and IRS Schedule D to report the gain or loss from the sales of capital assets. However, several exceptions exist.

You don’t have to file IRS Form 8949 or Schedule D

You don’t have to file Form 8949 or Schedule D if you aren’t deferring any capital gain by investing

in a qualified opportunity fund (QOF) and both of the following conditions apply to your tax situation:- You have no capital losses, and your only capital gains are capital gain distributions reported to you on IRS Form 1099-DIV, Box 2a; and

- None of the Form(s) 1099-DIV have any amounts in:

- Box 2b: Unrecaptured Section 1250 gain

- Box 2c: Section 1202 gain, or

- Box 2d: Collectibles (28%) gain

You don’t have to file IRS Form 8949

You must file Schedule D, but generally don’t have to file IRS Form 8949 if:

- The above exception does not apply,

- You are not deferring capital gains by investing in a QOF or terminating a deferral from a QOF investment, and your only capital gains and losses are:

- A capital loss carryover from a previous tax year

- An undistributed long-term gain from IRS Form 2439

- Gain from an installment sale reported on IRS Form 6252

- Long-term gain on the sale of business property reported in Part I of IRS Form 4797

- Gain or loss from a casualty or theft reported on IRS Form 4684

- Gain or loss from a Section 1256 contract reported on IRS Form 6781

- Gain or loss from a like-kind exchange reported on IRS Form 8824

- Gain or loss reported from a partnership, S corporation, estate or trust, or

- Gains and losses from transactions for which you received a Form 1099-B that shows:

- Basis was reported to the IRS

- QOF field in Box 3 is not checked, and

- You don’t need to make adjustments or enter codes in columns (f) or (g) of Form 8949

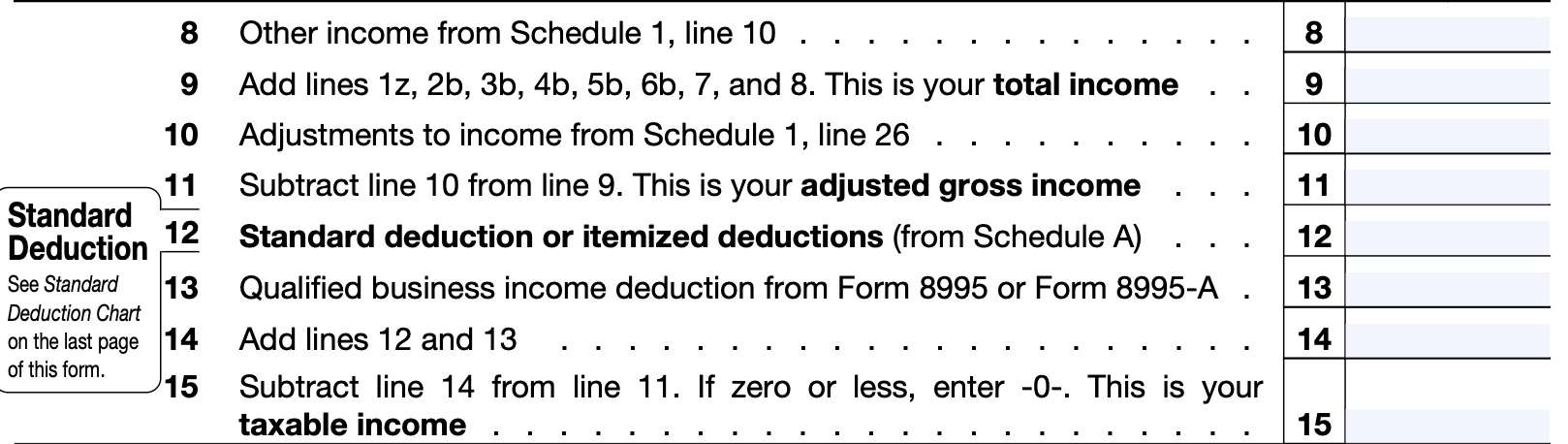

Line 8: Other income from Schedule 1, Line 10

Line 9: Total income

Add the following lines and enter the total in Line 9:

- Line 1z

- Line 2b

- Line 3b

- Line 4b

- Line 5b

- Line 6b

- Line 7

- Line 8

This represents your total income, before adjustments.

Line 10: Adjustments to income from Schedule 1, Line 26

Enter adjustments to income from IRS Schedule 1, Line 26.

These are known as adjustments to gross income, or above-the-line adjustments.

Line 11: Adjusted gross income

Subtract Line 10 from Line 9.

The result is your adjusted gross income, or AGI. This number is used to help determine a variety of things, including the income-related monthly adjustment amount (IRMAA) for Medicare, as well as various tax benefit phaseouts and limitations.

Line 12: Standard deduction or itemized deductions

Enter the larger of:

- Your standard deduction, as determined in the standard deduction chart, above, or

- Itemized deductions, as calculated on IRS Schedule A

If you had a net qualified disaster loss and you elect to increase your standard deduction by the amount of your net qualified disaster loss, you may need to use Schedule A to figure your standard deduction.

Line 13: Qualified business income deduction

If you have qualified business income (QBI), you may be able to take a deduction, which you can enter in Line 13. Taxpayers will calculate QBI on either:

- IRS Form 8995: Qualified Business Income Deduction (Simplified Computation), or

- IRS Form 8995-A: Qualified Business Income Deduction

You may use the simplified computation (Form 8995) if:

- You have qualified business income, qualified REIT dividends, or qualified PTP income (loss);

- Your taxable income before the qualified business income deduction is less than or equal to $170,050 (for single taxpayers)

- $340,100 if married filing jointly

If you don’t meet the criteria outlined above, use IRS Form 8995-A to calculate your QBI deduction.

Line 14

Add the deductions from Line 12 and Line 13. Enter the total here.

Line 15: Taxable income

Subtract Line 14 from Line 11, then enter the result. This is your taxable income.

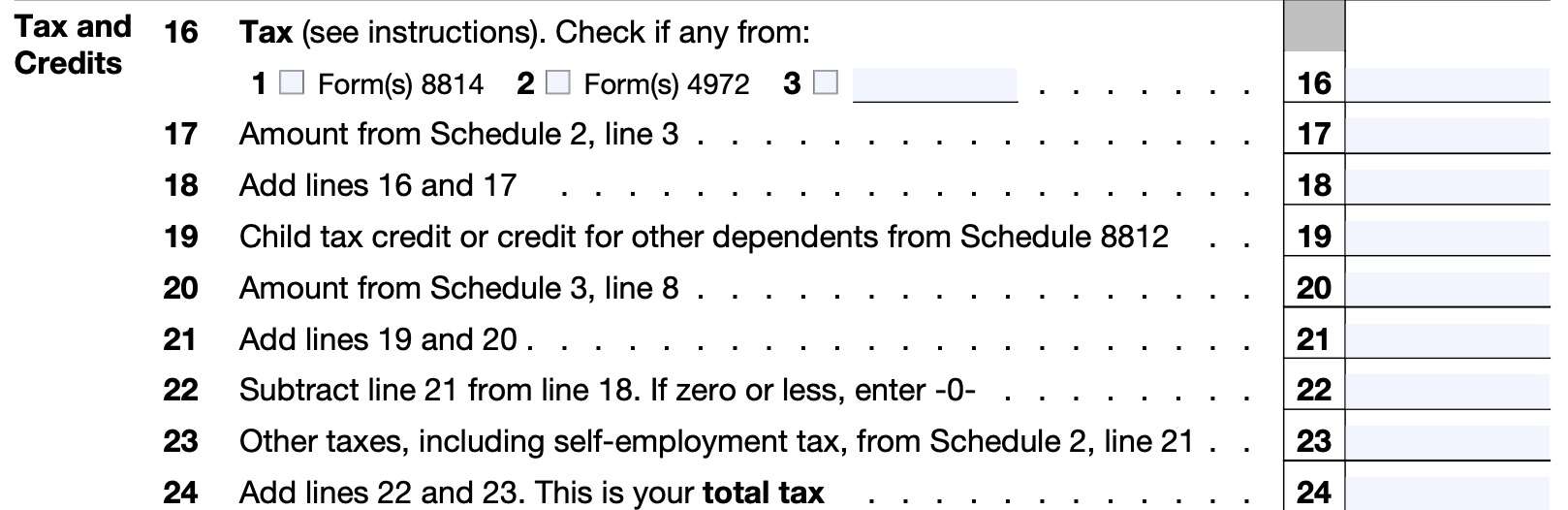

Tax and credits (Line 16 through Line 24)

In this section, we’ll calculate your tax liability and apply certain tax credits. Let’s start with calculating your tax on Line 16.

Line 16: Tax

Line 16 contains all of the following tax calculations, as they apply to your tax situation:

- Tax on your taxable income. Figure the tax using one of the methods described later.

- Tax from IRS Form 8814, relating to the election to report child’s interest or dividends

- Check Box 1 if applicable

- Check Box 2 if applicable

- Reduced by the amount of any foreign tax credits claimed on IRS Form 1118.

- Check Box 3, enter the amount and “962” in the space next to that box.

- Attach a statement showing how you figured the tax.

- May apply if you claimed an education credit in an earlier year, and either tax-free educational assistance or a refund of qualified expenses was received for the student

- Check Box 3, enter the amount and “ECR” in the space next to that box.

- Check Box 3, enter the amount of the tax and “1291TAX” in the space provided

- Check Box 3, enter the amount of the liability and “Form 8978” in the space next to that box.

- If the amount on Form 8978, Line 14, is negative, see the instructions for Schedule 3, Line 6l.

Calculating your tax liability

Generally, if your income is less than $100,000, you must use the tax tables provided in the IRS Form 1040-SR instructions to calculate your tax liability, based upon your filing status.

If your income is $100,000 or more, you would use the tax computation worksheet, also located in the Form 1040-SR instructions.

However, you may need to use other forms or worksheets, if they apply to your tax situation. Here is a list:

- IRS Form 8615, Tax for Certain Children Who Have Unearned Income

- Schedule D Tax Worksheet: Applicable if:

- Line 18 or Line 19 of Schedule D is greater than zero, or

- You file IRS Form 4952 to report investment interest expense, and there is a result on Line 4g

- Even if you don’t file Schedule D

- Qualified Dividends and Capital Gains Tax Worksheet

- Used if you don’t need to use the Schedule D Tax Worksheet, not filing IRS Form 2555 and:

- You reported qualified dividends in Line 3a, or

- You don’t have to file Schedule D and you reported capital gains distributions on Line 7, or

- You’re filing Schedule D and both Lines 15 and 16 are greater than zero, AND

- If you file IRS Form 2555, you must use the Foreign Earned Income worksheet, instead

- Used if you don’t need to use the Schedule D Tax Worksheet, not filing IRS Form 2555 and:

- Schedule J: Used by farmers and fishermen to report income using the income averaging method

- Foreign earned income worksheet

- Used by taxpayers who filed IRS Form 2555 to claim:

- Foreign earned income exclusion,

- Housing exclusion, or

- Housing deduction

- Used by taxpayers who filed IRS Form 2555 to claim:

Line 17: Amount from Schedule 2, Line 3

Enter any amount, if applicable, as reported on Line 3 of IRS Schedule 2, Additional Taxes. This includes the following:

- Alternative minimum tax reported on IRS Form 6251, and

- Excess advance premium tax credit repayment reported on IRS Form 8962

Line 18

Add Line 16 and Line 17. Enter the total in Line 18.

Line 19: Child tax credit or credit for other dependents from Schedule 8812

If applicable, enter any child tax credit or credit for other dependents as calculated on Schedule 8812.

If your tax credit was previously denied for a reason other than a math error or clerical mistake (i.e. disallowed), you may also need to file IRS Form 8862, Information to Claim Certain Credits After Disallowance.

Line 20: Amount from Schedule 3, Line 8

Enter any nonrefundable tax credits from Line 8 on IRS Schedule 3, Additional Credits and Payments.

Line 21

Add Line 19 and Line 20. Enter the total here.

Line 22

Subtract Line 21 from Line 18. If the result is zero or a negative number, enter ‘0.’

Line 23: Other taxes from Schedule 2, Line 21

Enter other taxes from IRS Schedule 2, Line 21.

For taxpayers with household workers, this also includes any household employment taxes calculated on IRS Schedule H.

Line 24: Total tax

Add Line 22 and Line 23. This represents your total tax liability.

Payments (Line 25 through Line 33)

In this section, we’ll total tax payments made throughout the year, as well as certain refundable tax credits that may help reduce your tax bill.

Line 25a: Federal income tax withheld from Form(s) W-2

Enter the total amount of federal income tax withheld, as reported on all W-2 Forms, in Box 2.

Line 25b: Federal income tax withheld from Form(s) 1099

In Line 25b, enter the total amount of federal tax withheld from all 1099 forms, as reported in:

- Form 1099: Box 4

- Form SSA-1099: Box 6

- Form RRB-1099: Box 10

Line 25c: Other forms

In Line 25c, enter any tax payments as reported on the following:

- IRS Form W-2G, Box 4

- IRS Form 8959, Additional Medicare Tax, Line 24

- Schedule K-1

- IRS Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding

- IRS Form 8805, Foreign Partner’s Information Statement of Section 1446 Withholding Tax

- IRS Form 8288-A, Statement of Withholding on Certain Dispositions by Foreign Persons

Attach any applicable form or schedule to your tax return.

Line 25d

Add Lines 25a through 25c, then enter the total here.

Line 26: Estimated tax payments and amount applies from previous year return

If you made estimated tax payments during the year, or applied any amounts from last year’s tax return to this year’s tax bill, enter the total amount in Line 26.

Line 27: Earned income credit (EIC)

If applicable, enter any earned income credit (EIC). Eligible taxpayers may calculate the EIC using the worksheet located in the form instructions or by completing Schedule EIC. Attach your completed Schedule EIC to your tax return.

Line 28: Additional child tax credit from Schedule 8812

If applicable, enter the additional child tax credit as calculated on Schedule 8812.

Line 29: American opportunity credit from Form 8863, Line 8

Enter the refundable portion of the American Opportunity Tax Credit as calculated on IRS Form 8863, Line 8.

Line 30: Reserved

Reserved for future use. Do not enter anything here.

Line 31: Amount from Schedule 3, Line 15

Enter all other payments and refundable tax credits as reported on Schedule 3, Line 15.

Line 32: Total other payments and refundable credits

Add the following:

Enter the total in Line 32.

Line 33: Total payments

Add the following lines and enter the total here:

If the total payments reported on Line 33 exceed your tax liability on Line 24, then go to Line 34 to calculate your tax refund. Otherwise, go to Line 37 to determine how much you owe.

Refund (Line 34 through Line 36)

Line 34: Amount you overpaid

Subtract Line 24 from Line 33. This is the amount of overpaid tax that the IRS owes you.

Line 35a: Amount you want refunded to you

If you want a complete refund, carry down the Line 34 number and enter it here. If you’d like some of your tax refund to apply to next year’s estimated tax, then subtract that amount (which you will enter in Line 36), and enter the difference here.

For taxpayers who wish to have part or all of your tax refund in the form of U.S. savings bonds or you want to split your refund into multiple accounts, complete IRS Form 8888 and check the applicable box. However, you cannot split your tax refund into more than one account or receive paper Series I bonds if you file IRS Form 8379, Injured Spouse Allocation, with your tax return.

Attach your completed Form 8888 to your tax return. If you file IRS Form 8888, you can skip Lines 35b through 35d.

Line 35b: Routing number

For direct deposit filers, you will complete Lines 35b through 35d.

Enter the routing number of your financial institution here. This is the nine-digit number that is unique to your financial institution.

Line 35c: Account type

Check whether your account is a checking account or a savings account.

Line 35d: Account number

Enter your account number in Line 35d.

Line 36

If you wish to apply some or all of your tax refund to next year’s tax liability, enter the amount in Line 36, then proceed to the signature section.

Amount you owe (line 37 through Line 38)

Line 37: Amount you owe

Subtract Line 33 from Line 24, then enter the result. If you owe an estimated tax penalty from Line 38, add the penalty to the total that you enter in Line 37.

Line 38: Estimated tax penalty

If you owe taxes with your income tax return, you may owe an estimated tax penalty if:

- Line 37 is at least $1,000, and is more than 10% of your tax liability, and

- You didn’t pay enough estimated tax throughout the year

- Even if you end up with a tax refund

Use IRS Form 2210 to calculate your estimated tax penalty (farmers and fishermen will use IRS Form 2210-F).

Add the estimated tax penalty to your outstanding tax bill. Enter the total in Line 37.

Signature

Sign this field, under penalties of perjury, that everything in your tax return is true, correct, and complete to the best of your knowledge.

If filing a joint tax return, both spouses must sign.

If using a paid preparer, such as a certified public accountant or enrolled agent, your paid preparer will enter their information in this section as well.

Video walkthrough

Normally, we cover tax forms in a single tutorial article, and post the link here. Because IRS Form 1040-SR is such a long form, we’ve broken this into sections, which we will add here.

If you’d like to see all of these instructional videos in one place, check out the IRS Form 1040-SR playlist on our YouTube channel!

Frequently asked questions

What’s the difference between IRS Form 1040 and IRS Form 1040-SR?There are several differences, specifically for older taxpayers. Form 1040-SR contains a large-print version of Form 1040 that is easier to complete, and a standard deduction chart is readily available for easy use. Taxpayers must be 65 or older to use the 1040-SR form.

What is the additional standard deduction for people over 65?For 2023, single taxpayers over the age of 65 or who are blind receive an additional $1,850, per person, as part of their standard deduction. Taxpayers who are both receive $3,700. For married taxpayers, this amount is $1,500 per person ($3,000 for both). In 2024, the amount increases to $1,900 ($1,550 for married couples).

Where can I find IRS Form 1040-SR?

You can find this tax form on the IRS website. For your convenience, the most recent version is attached to this article, just below.

- But if either (a) or (b) below applies, enter ‘0’ on Line 4b. You don’t have to refer to Form 8606 or its instructions.