Hire purchase is a type of instalment credit under which the hire purchaser, called the hirer, agrees to take the goods on hire at a predetermined rental, which is inclusive of the repayment of principal as well as interest, with an option to purchase.

Under this transaction, the hire purchaser acquires the property (goods) immediately on signing the hire purchase agreement but the ownership or title of the same is transferred only when the last instalment is paid to the owner (hiree). The hirer has the right to terminate the agreement at any time before the transfer of ownership of the asset.

In other words, the hirer has the option to purchase the asset. In case hirer decide to terminate the agreement, the hirer has to either

The hire purchase system is regulated by the Hire Purchase Act 1972.

This Act defines a hire purchase as “an agreement under which goods are let on hire and under which the hirer has an option to purchase them in accordance with the terms of the agreement and includes an agreement under which:

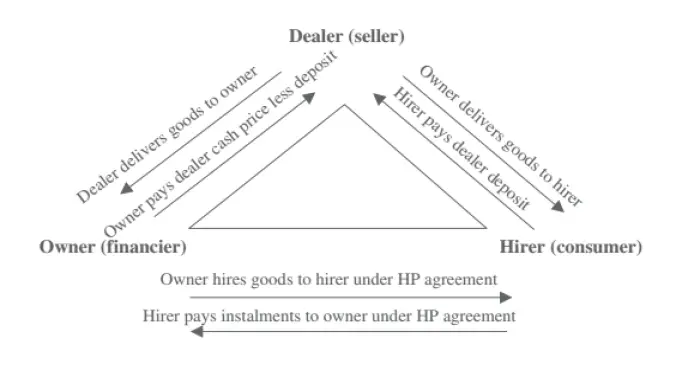

Hire purchase should be distinguished from instalment sale wherein ownership of the property passes to the purchaser with the payment of the first instalment. But in case of Hire purchase ownership remains with the seller until the last instalment is paid buyer gets ownership after paying the last instalment. The figure depicts a typical hire-purchase transaction between the parties.

Hire purchase (as per Hire Purchase Act 1972, India) is a typical transaction in which the assets are allowed to be hired and the hirer is provided an option to later purchase the same assets. Following are the features of a regular hire purchase transaction:

Advantages of Hire Purchase system are:

Disadvantages of Hire Purchase System are:

Essentially, both lease financing and hire purchase are the options of financing the assets. These options vary from each other in many aspects viz. ownership of the asset, depreciation, rental payments, duration, tax impact, repairs and maintenance of the asset and the extent of finance.

These are discussed as follow:

There is no exclusive legislation dealing with hire purchase transaction in India. The Hire purchase Act was passed in 1972. An Amendment bill was introduced in 1989 to amend some of the provisions of the act. However, the act has been enforced so far. The provisions of are not inconsistent with the general law and can be followed as a guideline particularly where no provisions exist in the general laws which, in the absence of any specific law, govern the hire purchase transactions. The act contains provisions for regulating:

• The format / contents of the hire-purchase agreement

• Warrants and the conditions underlying the hire-purchase agreement,

• Ceiling on hire-purchase charges,

• Rights and obligations of the hirer and the owner.

In absence of any specific law, the hire purchase transactions are governed by the provisions of the Indian Contract Act and the Sale of Goods Act.

Financial Accounting

( Click on Topic to Read )